中国式骗子:薛蛮子、金融科技、P2P和ICO 德勤Fintech全球报告:八种力量正改变金融科技的未来

ICO是什么?相信大多数人都不知道,但很多人都知道ICO可以爆利,对标的比特币已经涨了N万倍了。

Fintech是什么?相信大多数人都不知道,但很多人都知道P2P,都知道e租宝,很多人投资p2p发财了,也有很多人本金没了。

越来越多的大妈投资者和刚毕业梦想发财的新生投资者喜欢从p2p到ico的各种赌博式投资,反正赢了会所,输了继续!。

但Fintech本身不是一个恶魔,ICO也不是一个噩梦,为什么在海外规范市场可以,在中国总是一搞就乱,一管就死呢?

这就是中国的现实!而从p2p到ico正是符合了中国人国民性的赌博心理!

向小田发过一个段子,大概意思是这样的,为什么骗子总是用年收益50%或者更高的收益去骗人呢?这种不可能不是常识吗?但骗子的逻辑非常清楚,就是自动过滤掉有脑子的人,只要是停下来听的就一定就是骗子的目标客户群。

薛蛮子的历史就是赌博的历史

这次有关方面采取断然措施整顿ICO是非常正确的,上一轮p2p的危机中,一夜之间冒出这么多骗子公司,现在已经成为巨大的社会问题,刹车都没有办法了。

上周碰到一家管理着差不多1000亿财富的p2p公司,手中有2家上市公司的壳,全国几百家门店,每天收钱不敢停,但收钱了没地方投资,2家上市公司也被641卡着不能运作,这样前面相当于高利贷吃进钱,后面你没有这样的高收益应付,就不知道那天就只能断裂了。这就是目前p2p公司的现状。

而为什么薛蛮子来了,有关部门要采取断然措施呢。其实看下薛蛮子的经历就知道了。

虽然薛蛮子号称是天使投资人,但其实你看看他投资的东西呢,作为二代,当然薛蛮子有自己的资源,当年第一桶金是和胡子一起搞定了****,后来最大的合伙者是蔡文胜,其实新浪微博的很多草根,各种垃圾V都是他们家的。薛蛮子的投资就是赌博一个时代。而后来随着其嫖娼事件告一段落。

后来,不知道怎么,薛蛮子竟然重启了,并且一下子投资了n多ICO,你想有关部门当初容忍P2P发展,结果形成现在金融系统的不可收拾的局面,怎么可能再容忍ICO这种乱象。支持当局干死他们家姥姥。

中国投资环境,中国企业文化的巨大毛病,就是企业家不真诚,说谎!大概这是中国从幼儿园开始教育的病吧。当然还有一个巨大的毛病就是喜欢赌博,小编不知道,这应该怪麻将吗?

Fintech不是都是坏的

在小编的眼中,虽然p2p已经被搭上了骗子的标记,然后大家都转型叫做Fintech,后来这个词也被用坏了。但从国际趋势看,Fintech是一个必然的过程。就中国来看,四大行基本是为国企服务,其他中小银行也都为各自地方服务,但对于成千上万的屌丝人群,基本没有服务。

传统的银行无法适应互联网时代,才有了马云的余额宝,才有了支付宝,而传统的银行用传统的体制和模式完全无法适应变革。比如小编手机中有好几个银行的APP,如果你要二维码支付,你必须登录,然后找到。。。。世界上哪个傻逼会这么做?所以银行的二维码支付失败是完全必然的,事实上 ,去年苹果和银联以及很多银行还一起推过苹果支付,我艹,浪费这么多钱然后就没有声音了。传统的死亡是个事实,谁都改变不了。

小编接触到的一些金融科技公司,默默的开始做着基础工作,成为银行的补充,但现在p2p和Fintech实在太多了,监管还是得为都比较单纯幼稚有赌博心态的老百姓多做点事情了。

其实,对于Fintech,德勤的这份报告说的清楚了,这是必然趋势,但要慢慢来!所有投身于金融科技的都需要又一种长期发展,而不是赌博的心态!谁规范发展,谁慢慢来,谁就能活到最后。

Based on these insights, we’ve identified eight forces that have the potential to shift the competitive landscape of financial services:

1. Cost commoditization 成本的商品化

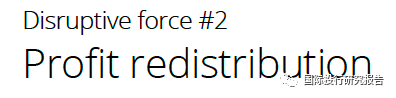

2. Profit redistribution利润再分配

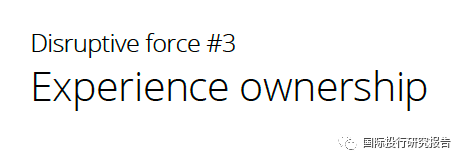

3. Experience ownership

4. Platforms rising

5. Data monetization

6. Bionic workforce

7. Systemically important techs

8. Financial regionalization

In the pages that follow, we describe each of these forces and break down the implications for incumbents,fintechs, and regulators. We also offer supporting examples from across seven financial services sectors:payments, insurance, digital banking, lending, investment management, equity crowdfunding, and market infrastructure.

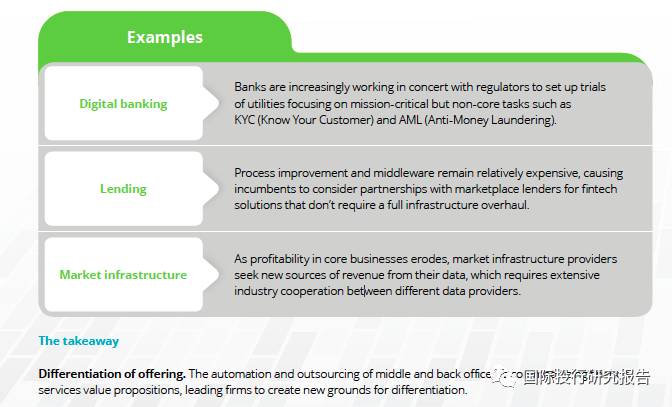

Operating cost is becoming less of a competitive advantage. Firms are exploring new technologies and working with other organizations—competitors and new entrants alike—to accelerate the commoditization of their costbases so they can preserve margins and focus on more promising strategies.

One approach is to create a new utility that standardizes processes and avoids duplication of work among thecompanies it serves. Another is to source out an expanded range of activities (risk management is a recentexample). Finally, there’s automation. While financial institutions have always embraced enabling technologies,new tools have become available to streamline processes such as loan origination, audit compliance, and accountreconciliation.

Between cost-sharing with peers and the use of industry-standard tools, the financial services value chain willflatten. In response, the industry will pay greater attention to partnerships and the overall ecosystem. Security andpermissions will be treated independently to minimize the threat from any new external connection. Firms will also step up their protection of user data as they share more information with external organizations.

Incumbent firms have additional work to do. They’ll need to find ways to differentiate their customer-facingprocesses as their middle and back offices become indistinguishable from those of competitors. Regulators will stay busy tracking utilities and business service providers for potential risk.

Technology is shaking up the financial services value chain. Investment firms are using exchange-traded funds(ETFs) to entice customers away from savings deposits. Online sellers are accepting payments via web applications,precluding the need for a traditional merchant bank account. Incumbent institutions are pairing with startups in waysthat put them in competition with their traditional partners. And regulators are curtailing financial institutions’ controlover access to infrastructure. The result of all this activity? An industry-wide redistribution of profits.

Intermediaries will feel the pinch from both sides. As technology reduces the cost of bypassing them to reach the endcustomer, intermediaries will need to find other opportunities to profitably add value. Meanwhile, fintech companieswill gain an expanding pool of potential partners that offer scale and customer reach. The challenge for regulators willbe to understand how shifting fortunes are reshaping the value chain, with long-regulated companies giving ground to new ones.

Traditionally, many financial institutions distribute the products they create. But with platforms and alternative channels on the rise, prudent incumbents are planning for conditions where distribution is beyond their control.

Recognizing that the balance of power swings to those who own the customer experience, dedicated producers of financial offerings are weighing strategies that call for extreme scale or focus.

Current trends offer an early glimpse of this post-integrated world. Customers buy ETFs from a wide range of companies that offer robo-advisory services. They download apps from providers that stringently control which products to display. And when it comes to advisory services, retail businesses are liable to be influenced by benchmarks and recommendations from a distributor with sweeping visibility into comparable retail data.

If trends like these take hold, customers will interact with increasingly fewer distributors as the market consolidates.

Large technology firms and incumbent financial institutions have the advantage, the former due to their rich customer data and the latter because of their brand and existing customer base. However, that won’t stop other firms from seeking to become distributors, for their own products as well as for others. Fintechs may find niches that help them compete. And if an incumbent firm fails to establish a distributorship, it risks declining profits as its products become commodities.

The regulator’s role in all this will be to guard against abuses of the market power that product distributors hold. This will be so especially for open platforms where distributors control the customer shopping experience. Another open question, one with far-reaching consequences, is how distributors and manufacturers will share liability in such an environment.

Customers are demanding more choices in financial services—and, increasingly, they expect one-stop shopping.

Institutions are scrambling to respond, turning to digital platforms that enable them to deliver in multiple geographies, often alongside other providers.

Eventually, these platforms will become the primary means of distributing financial products. Business and retail customers, for example, will be able to purchase credit and asset management services from an online storefront of competing vendors. Buyers and sellers in the capital markets will be matched through platforms that accommodate a wide range of trades.

This development will have several effects on the industry. For firms, product differentiation will become critical.

That means putting an end to loss leaders—products will have to stand on their own—and accepting that price shoppers will favor large incumbents who enjoy product economies of scale. Meanwhile, platform owners will have to balance product manufacturer needs against customer demand. Platforms will naturally capture market data from all participants, adding to the market power of the platform owner.

All participants must address the liability of products placed on public platforms, and regulators will have to decide on the responsible party in each market.

1.【获得报告】扫一扫下面二维码给群主点赞,同时转发朋友圈, 写下留言或私信,就可获得文中提到的各种研究报告全文链接。

2.【加入讨论】近400名著名券商PE/VC/媒体人已经加入。扫一扫下面二维码给群主点赞,并转发朋友圈,同时在留言中留下实名制信息(姓名+公司+手机+微信+研究方向),审核通过可加入讨论群,交流各种研究报告和成果。

3.转载请注明出处,联系一下更好!文章只是读报告的信息集合,不构成任何投资建议